CAN I USE AN SBA 7(A) LOAN FOR BUSINESS ACQUISITION?

If you’re a business owner looking to expand your operations, an SBA 7(a) loan can be used to buy another business. SBA 7(a) loans can also be used for additional expansion-related borrowing, such as expanding through a real estate acquisition, increasing your working capital, or equipment purchases.

The SBA 7(a) loan is extremely popular—it’s the most used loan backed by the Small Business Administration (SBA).

Why an SBA Preferred Lender Saves You Time

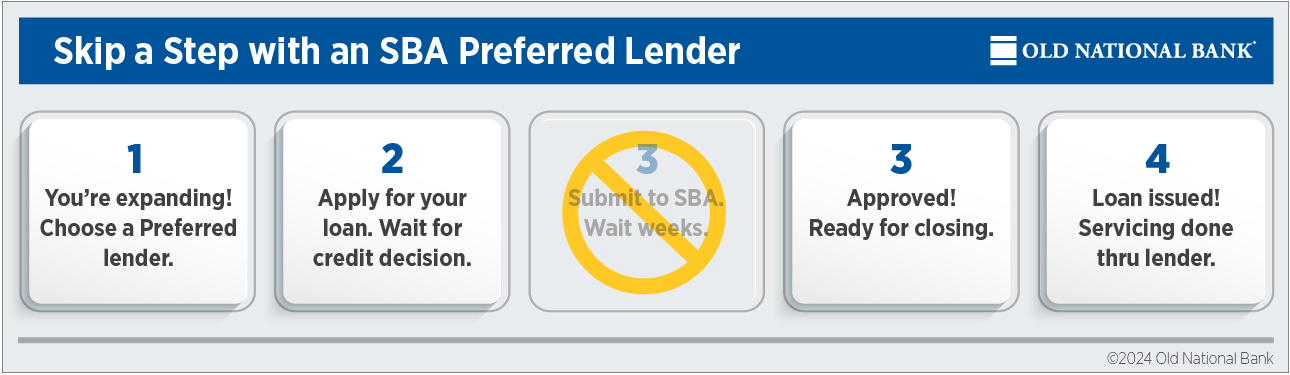

Though they’re backed by the Federal government, SBA 7(a) loans are issued by banks and credit unions. When you choose an SBA Preferred Lender, you’ll work with a bank that has years of experience processing SBA loans.

This can be important. The SBA has eligibility requirements, so any applicant will face additional forms. An SBA Preferred Lender can prepare you for a smooth process and quickly spot errors or omissions in your paperwork. Equally important, SBA Preferred Lenders, such as Old National Bank, have SBA approval authority to make final credit decisions at the bank level on SBA 7(a) Loans. This could potentially save weeks in processing time.

In contrast, non-preferred lenders would need to submit your completed application to the SBA for a final approval, after they’ve made their credit decision. The second level of SBA review and approval can cost you time, because it’s another round of decisioning to wait on. If you receive an SBA notice that additional information is required or if something was filled out or submitted incorrectly, the result is further delays to resubmit requested information and wait for the subsequent review and their decision.

As a result, in-house credit decisioning approvals from a Preferred SBA Lender can substantially simplify and speed up the process.

Does It Matter Which Bank You Choose for an SBA 7(a) Loan?

SBA 7(a) Loans are appealing because they typically offer longer terms than are available to small business owners in the open market. For example, the maximum term length for a loan for real estate purchases is 25 years. It’s 10 years for business acquisitions, for most equipment purchases, and for working capital loans and leasehold improvements. Plus, there are also interest rate caps that keep SBA 7(a) rates highly competitive.

However, within these guidelines, your loan will depend not just on your creditworthiness, but also on what a lending institution is willing to offer. For example, at Old National Bank, for SBA 7(a) Business Acquisition Loans, we offer fully fixed interest rates to qualified applicants. Many institutions don’t do this—they only write these loans with variable rate options, exposing their clients to interest rate risk.

Similarly, while there are term maximum guidelines, not all lenders will extend clients to the maximum available term. We recommend talking to several lenders and getting a sense of what is available and which solution best fits your business.

In this sense, not all SBA 7(a) loans are the same. Where you get the loan matters—you want to work with an institution that’s willing to find flexible financing solutions to meet your needs. Plus, if you work with an SBA Preferred Lender, you’ll work with a lender who has a more nuanced understanding of what options are available, as well as faster processing times.

What Are Some Other Benefits of an SBA 7(a) Loan?

In addition to competitive interest rates and longer terms, several other benefits stand out. SBA 7(a) loans typically allow for smaller down payments than most comparable open market options. They also allow the borrower to have a collateral shortfall, meaning that if their collateral is not worth the total amount of the loan, the loan could still be issued.

As far as repayment, SBA 7(a) loans require monthly repayments at a set regular amount, if you have fixed interest. If you have a variable rate loan, monthly repayment amounts may fluctuate, but within pre-set boundaries. Either way, the repayment structure will probably feel like a home mortgage—simple and straight forward.

More importantly, there are no balloon payments. This can be a big stress reliever—and a major benefit to growing a business.

Who Qualifies for an SBA 7(a) Loan?

Loan eligibility is outlined by the Small Business Administration. In short, you must be an eligible for-profit business located within the U.S. You also must fit the SBA size requirements for being a “small” business, and you must demonstrate that you were unable to find the credit you need at reasonable terms from non-governmental sources. You must also demonstrate creditworthiness and the ability to repay your desired loan.

A banker who regularly processes SBA loans can walk you through the criteria and what paperwork is needed to demonstrate your eligibility.

In Conclusion: SBA 7(a) Loans Can Be Used for Business Acquisitions

For many small businesses, an SBA 7(a) loan may in fact be the best choice. It offers favorable term lengths, highly competitive interest rates, and predictable repayment provisions. When you choose an SBA Preferred Lender, you work with a bank that has experience processing the paperwork and can expedite the process by skipping an approval step. If you’re interested in an SBA 7(a) loan to expand your business, it may make sense to talk with a local banker today.